Klever Blog

EBA's New Environmental Scenario Analysis Guidelines: What Banks Need to Know

Environmental scenario analysis becomes mandatory for EU banks by 2027. Here’s what the EBA’s final guidelines mean for risk teams—and how to prepare.

While ESG regulation has been rolled back in many areas, the latest move from the European Banking Authority (EBA) confirms banks remain firmly in the spotlight. The EBA has released its final “Guidelines on environmental scenario analysis,” setting the tone for how financial institutions must assess environmental risks going forward.

EBA — Guidelines on environmental scenario analysis

Mandatory implementation by 2027

For more than 2,000 EU banks, conducting environmental scenario analyses will become mandatory at the latest from the beginning of 2027. Although the scope and timeline have been eased slightly since the consultation draft, the resulting obligations require substantial investment in data, tooling, and expertise.

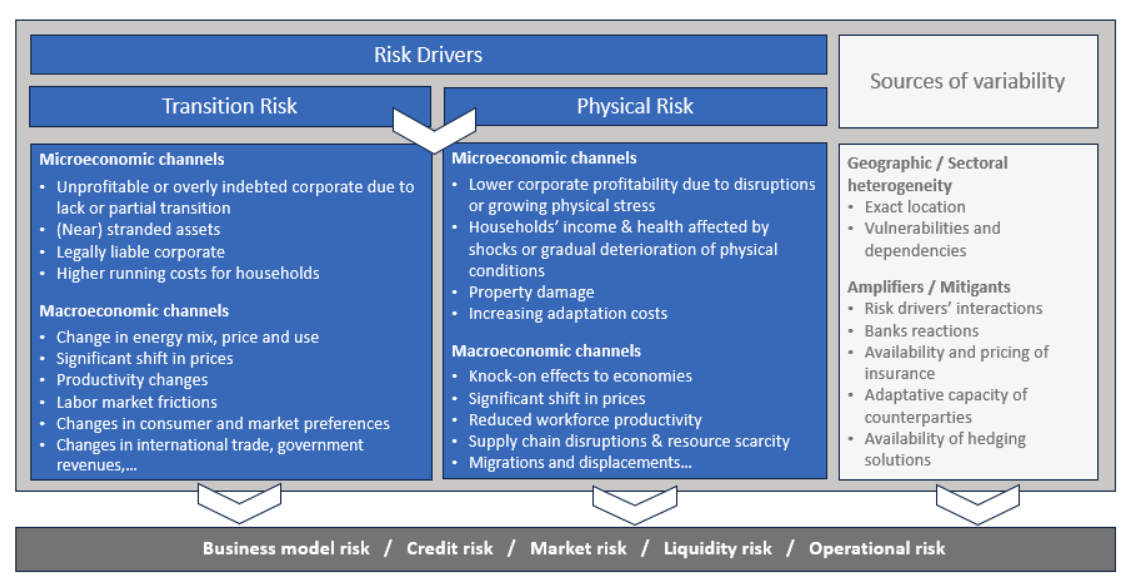

Banks will need to build playbooks that translate environmental shocks into their familiar risk taxonomies. The guidelines don’t prescribe exactly how outcomes feed governance or capital decisions, but they do expect management to understand the transmission channels.

Understanding environmental risk transmission

Scenario exercises should not sit apart from core risk management. Instead, they help teams examine how environmental drivers can trigger credit, market, liquidity, or operational losses over different time horizons. The EBA leaves substantial room for judgement, but expects banks to demonstrate a logical, well-documented chain of impacts.

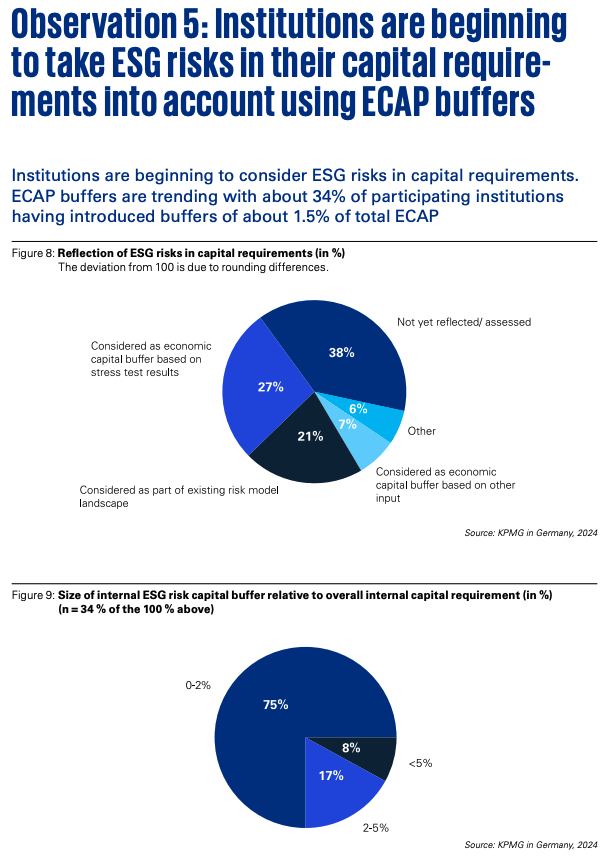

Growing integration with capital requirements

A 2025 KPMG survey shows around 34% of banks already consider ESG risks in their capital requirement processes. As environmental scenario exercises become mandatory, that percentage is likely to rise—especially where supervisors expect climate risk findings to feed ICAAP and stress testing frameworks.

The main challenges

Banks cite three recurring obstacles when scaling environmental scenario analysis:

- Adequate, decision-ready data with traceability to source documents.

- Appropriate tooling to build, run, and visualise scenarios across portfolios.

- Clear understanding of transmission channels between environmental drivers and financial outcomes.

How Klever can help

Klever’s ESG data services are designed to support banks along each of these dimensions. We deliver transparent, traceable datasets that plug into internal models, offer analytical tooling for climate scenario work, and provide subject-matter expertise to map environmental drivers into financial risk language.

As environmental scenario analysis becomes part of day-to-day banking operations, having the right data partner turns regulatory compliance into a strategic advantage. We’re working with Nordic banks to meet the new expectations and accelerate decision-making with better information.

Interested in discussing how Klever can support your scenario analysis programme? Get in touch—we’d love to help.