Klever Blog

What's Ahead for Bank Climate Work?

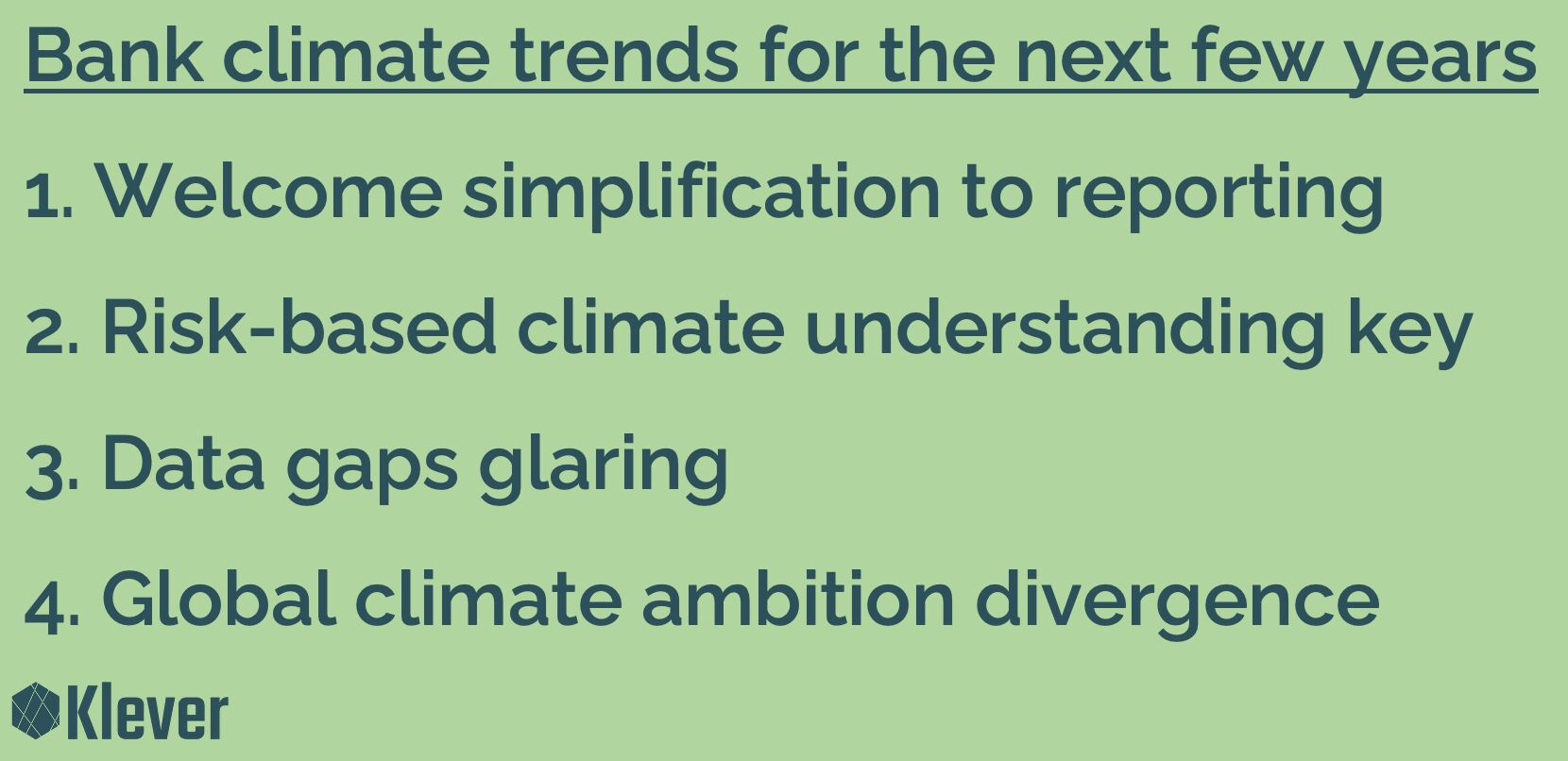

Four forces will shape how banks tackle climate over the next few years - from disclosure simplification to sharper, risk-based analysis.

Through discussions and reading, we have developed a view that four trends will shape bank climate work during the next few years.

- Welcome simplification to ESG disclosures. The EU plans to streamline banks' ESG reporting requirements. Few will miss nearly 100 pages of Green Asset Ratio tables in annual reports. Banks, especially smaller ones, now have some breathing room before updated rules land.

- Risk-based climate understanding more important than ever. Regulators are not easing expectations around knowing the climate exposures within lending books. Banks will keep sharpening scenario analysis, risk-based insight into climate effects, and physical risk assessments.

- Data gaps are glaring. With Omnibus, hopes for a grand, unified sustainability reporting approach have faded. ESRS was meant to help mid-sized company data, but a sizable gap remains.

- Global divergence in climate action. In the US, several banks have scaled back climate commitments, unraveling initiatives like NZBA. In the Nordics, ambition levels remain high. Banks taking decisive action will stand out, especially with the newly finalized SBTi Financial Institution Net Zero standard providing external validation.

All in all, interesting years lie ahead. Let's go!